In the ever-evolving landscape of cryptocurrencies, mining machine hosting has emerged as a pivotal strategy for investors seeking to capitalize on digital assets without the hassles of direct operation. Picture this: you’re an investor with a keen eye on Bitcoin (BTC), Ethereum (ETH), or even the whimsical Dogecoin (DOG), but the thought of managing noisy, power-hungry rigs in your basement sends shivers down your spine. Enter mining machine hosting contracts—a savvy solution that allows you to own and profit from mining equipment while experts handle the technicalities. These contracts not only streamline the process but also enhance efficiency, reduce risks, and potentially boost returns in a market as volatile as the open sea. By partnering with companies specializing in selling and hosting mining machines, investors can dive into the world of BTC mining, ETH staking variations, or DOG’s lighter demands, all while focusing on strategic decisions rather than daily maintenance.

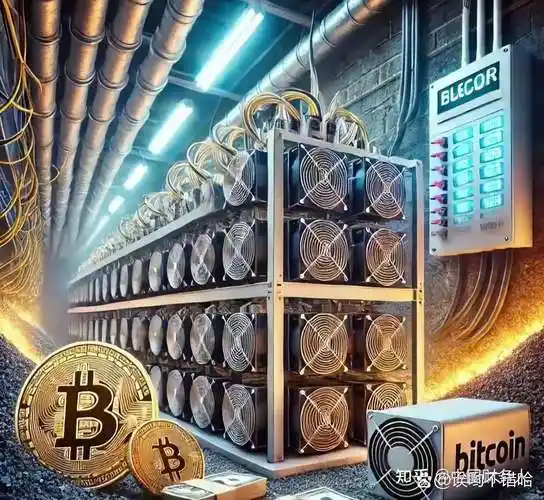

At its core, a mining machine hosting contract is an agreement where you purchase or lease high-performance miners—specialized computers designed to solve complex cryptographic puzzles—and have them operated in professional facilities known as mining farms. These farms, often equipped with state-of-the-art cooling systems and renewable energy sources, host thousands of mining rigs that churn out rewards in cryptocurrencies like BTC, ETH, or DOG. Imagine the thrill of earning passive income from your investments, as your miner joins a symphony of hardware in a data center, methodically validating transactions on blockchain networks. The diversity of available machines is staggering; from ASIC miners optimized for BTC’s proof-of-work algorithm to versatile rigs that adapt to ETH’s evolving consensus mechanisms, there’s a fit for every investor’s portfolio. This setup not only democratizes access to mining but also mitigates environmental concerns, as hosted facilities often employ energy-efficient practices that outpace haphazard home setups.

Delving deeper, let’s explore the intricacies of these contracts and how they tie into popular cryptocurrencies. For BTC enthusiasts, hosting contracts provide a direct pathway to the world’s first and most renowned cryptocurrency, where miners compete to add blocks to the blockchain and earn rewards. The process is far from mundane; it’s a high-stakes game of computational power, where your hosted miner could be the one cracking the code for the next block. Contrast this with ETH, which has shifted towards proof-of-stake, making hosting services adaptable for staking nodes that require less electricity but demand reliable uptime. Then there’s DOG, the meme-inspired coin that thrives on community hype—hosting a rig for DOG mining might involve less intensive hardware, allowing investors to experiment with lower barriers to entry. Exchanges play a crucial role here too, as hosted earnings can be seamlessly converted or traded, turning raw mining output into diversified assets. The unpredictability of crypto markets means that a well-structured hosting contract can be your shield against downturns, offering flexibility through options like revenue sharing or fixed returns.

Mining farms, the backbone of this ecosystem, are vast warehouses filled with rows upon rows of miners and rigs, optimized for maximum output and minimal downtime. These facilities handle everything from power supply fluctuations to software updates, ensuring your investment runs smoothly around the clock. For instance, a typical mining rig—a assembly of GPUs, CPUs, and cooling fans—might be dedicated to ETH’s demands, while a specialized miner focuses solely on BTC’s SHA-256 algorithm. The burst of activity in these farms is palpable; one moment, a rig hums steadily, the next, it surges with energy as it processes a block. Investors benefit from this setup by avoiding the pitfalls of individual ownership, such as equipment failures or regulatory hurdles, and instead enjoy the economies of scale that professional hosting provides. Whether you’re eyeing the stability of BTC, the innovation of ETH, or the fun of DOG, these farms make the mining journey accessible and efficient.

Of course, no guide would be complete without addressing the potential pitfalls and how to navigate them. Burstiness in crypto prices can make hosting contracts a double-edged sword; while a BTC bull run might multiply your returns, a sudden dip in DOG’s value could erode profits. That’s why savvy investors scrutinize contract terms, such as hosting fees, electricity costs, and payout structures, to ensure they’re getting a fair deal. Diversifying across currencies like BTC, ETH, and DOG can add rhythm to your strategy, balancing high-reward opportunities with more stable options. Moreover, reputable hosting providers often integrate with exchanges for easy withdrawals, allowing you to swap mined coins for fiat or other assets at optimal times. The key is to approach these contracts with a blend of caution and enthusiasm, treating them as tools in a larger investment orchestra.

As we wrap up this exploration, remember that mining machine hosting contracts represent more than just a transaction—they’re a gateway to the pulsating heart of the crypto world. From the rugged reliability of BTC miners to the adaptive nature of ETH rigs and the lighthearted appeal of DOG setups, these agreements empower investors to engage without getting bogged down in details. With the right contract, you could be reaping rewards from a global network of mining farms, all while sipping coffee in your living room. So, whether you’re a novice or a seasoned trader, embrace the diversity of this space, and let your investments flourish in the dynamic dance of cryptocurrencies.

Leave a Reply